It would be easy to focus on some travel industry news right now when Florida and other states in the southern part of the US are in the news, but my mind is elsewhere. The loss of life is horrific, with total losses not known as yet. Not only are thousands, if not millions, suffering the consequences of Hurricane Helene but now, they are bombarded with the reality of Hurricane Milton making landfall tomorrow.

We have many friends and some family members who have evacuated. Still, others have decided to stay behind after taking many precautions to protect their homes and safety. But, based on current reports, they may still be in danger with the predicted high winds and water surges.

We are in frequent communication with those friends, hoping and praying to hear in days to come that they are safe. On the other hand, their properties may have sustained severe damage, often not covered by insurance. Those inland and some near the sea may not have purchased flood/hurricane insurance.

We are so sorry to hear you might be facing such a situation. Losing a home to a hurricane is a devastating experience, both emotionally and financially. In terms of your mortgage, here’s what typically happens when a natural disaster destroys a home:

1. Mortgage Responsibility

Even if your home is destroyed, your mortgage doesn’t automatically disappear. You’re still responsible for paying it, as the loan is tied to the debt, not the physical structure. The land remains an asset, and the lender has a claim until the loan is fully repaid.

2. Homeowners Insurance

If you have homeowners insurance, this can be a huge relief. Most policies include coverage for natural disasters like hurricanes, though it’s essential to confirm if hurricane-related damage is covered (wind vs. flood damage may be treated differently). The insurance payout would typically help with either:

- Repair or rebuild the home: Depending on the extent of the destruction, the funds will go toward rebuilding your house or repairing the damage.

- Pay off the mortgage: If rebuilding isn’t feasible, you may use the insurance money to pay off the remaining mortgage balance. However, you would need to cover any shortfall between what insurance covers and the outstanding balance.

3. Flood Insurance

If the damage was caused by flooding (as opposed to wind or rain), and you don’t have flood insurance, it could get complicated. Many standard homeowners insurance policies exclude flood damage, so you might be on the hook for the repairs. This could also affect your ability to pay off the mortgage, as insurance may not fully cover the destruction.

4. Mortgage Forbearance or Relief

In disaster scenarios, many mortgage lenders offer temporary forbearance, allowing you to pause or reduce mortgage payments for a limited period. This gives you time to assess the situation, work with insurance companies, and rebuild. It’s important to note that forbearance doesn’t erase the debt; you’ll still need to catch up on missed payments later.

5. Rebuilding or Selling

You may decide to rebuild, and your insurance payout can be used. Alternatively, if the property is beyond repair and the insurance doesn’t fully cover the mortgage, you could sell the land to help pay off the remaining balance.

6. Government Assistance

FEMA and other disaster-relief programs can provide some financial help, though this is typically limited and not designed to replace complete losses. Any federal assistance you receive is usually aimed at immediate needs, not necessarily long-term mortgage relief.

Emotional Impact: Losing a home comes with a deep sense of loss and instability, and dealing with the financial aftermath can add to the emotional weight. There’s often a strong psychological attachment to a home—it’s more than just walls and a roof. Rebuilding, emotionally and financially, takes time and patience, and it’s essential to seek support from family, friends, or professional counselors to navigate the stress of the situation.

Have you had a chance to check your insurance policy or contact your mortgage lender yet?

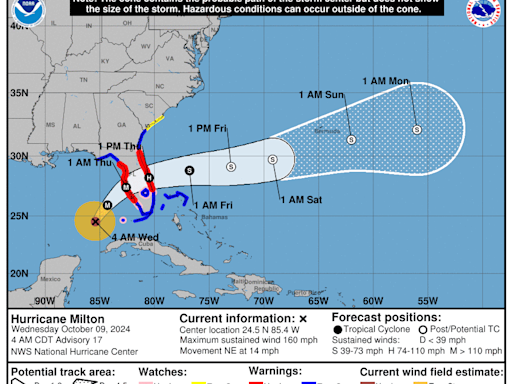

When hurricanes land, they may drop their category classification, from a five to a four or less. Let’s hope and pray that will be the case when Milton hits in the next 24 hours.

Be well.

Photo from ten years ago today, October 9, 2014:

|

|